Inspector Inland Revenue Test today solved paper Batch 1 10:00 Am held on 21st February 2022. Download today IIR Inspector Inland Revenue 21-02-2022 FPSC past paper of 2022 along with answer key.

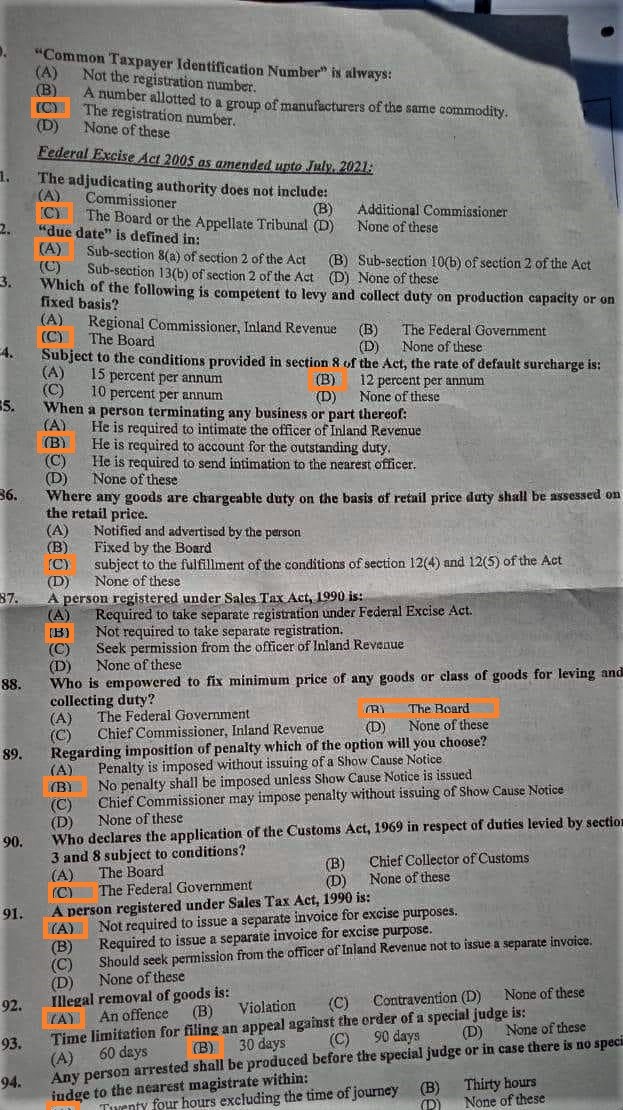

Inspector Inland Revenue Fully solved paper Batch 1

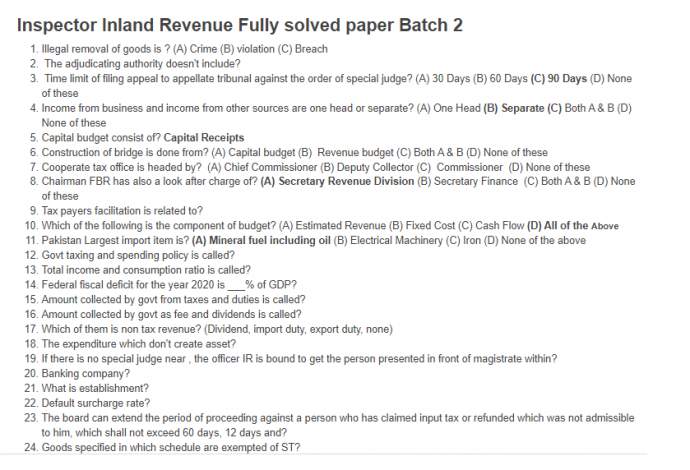

- Illegal removal of goods is ? (A) Crime (B) violation (C) Breach

- The adjudicating authority doesn't include?

- Non Tax Revenue is ? (A) Export duty (B) Import Duty (C) Dividends (D) None of these

- Time limit of filing appeal to appellate tribunal against the order of special judge? (A) 30 Days (B) 60 Days (C) 90 Days (D) None of these

- Income from business and income from other sources are one head or separate? (A) One Head (B) Separate (C) Both A & B (D) None of these

- Capital budget consist of? Capital Receipts

- Construction of bridge is done from? (A) Capital budget (B) Revenue budget (C) Both A & B (D) None of these

- Cooperate tax office is headed by? (A) Chief Commissioner (B) Deputy Collector (C) Commissioner (D) None of these

- Chairman FBR has also a look after charge of? (A) Secretary Revenue Division (B) Secretary Finance (C) Both A & B (D) None of these

- Tax payers facilitation is related to?

- Which of the following is the component of budget? (A) Estimated Revenue (B) Fixed Cost (C) Cash Flow (D) All of the Above

- Pakistan Largest import item is? (A) Mineral fuel including oil (B) Electrical Machinery (C) Iron (D) None of the above

- What is meant by Depreciation ?

- When a person is terminating a business he is required to ?

- Govt taxing and spending policy is called?

- Total income and consumption ratio is called?

- Federal fiscal deficit for the year 2020 is ___% of GDP?

- Amount collected by govt from taxes and duties is called?

- Which of them is non tax revenue? (Dividend, import duty, export duty, none)

- The expenditure which don't create asset for the Government ?

- If there is no special judge near , the officer IR is bound to get the person presented in front of magistrate within?

- Banking company?

- What is establishment?

- Default surcharge rate?

- The board can extend the period of proceeding against a person who has claimed input tax or refunded which was not admissible to him, which shall not exceed 60 days, 12 days and?

- Goods specified in which schedule are exempted of ST?

- To whom the board place the notifications of exemptions for approval?

- Zero rated and tax exempted good are same ?

- Penalty where a person repeats an offense?

- Appeal to appellate tribunal is made within?

- Inspector Inland Revenue Responsible for ?

- Amount collected by Government as taxes and duties is known as ?

- Case of the taxpayer is ?

- Fake and Flying invoices are relatable to ?

- Good Tax System is based on ?

If you remember MCQs of Inspector Inland Revenue Batch 1 Paper please share below in comments . You can also share your obtained marks as per answer keys of Batch 1.

Also Check

Inspector Inland Revenue Batch 2 Solved Past Paper 21st February 2022 10:00 Am