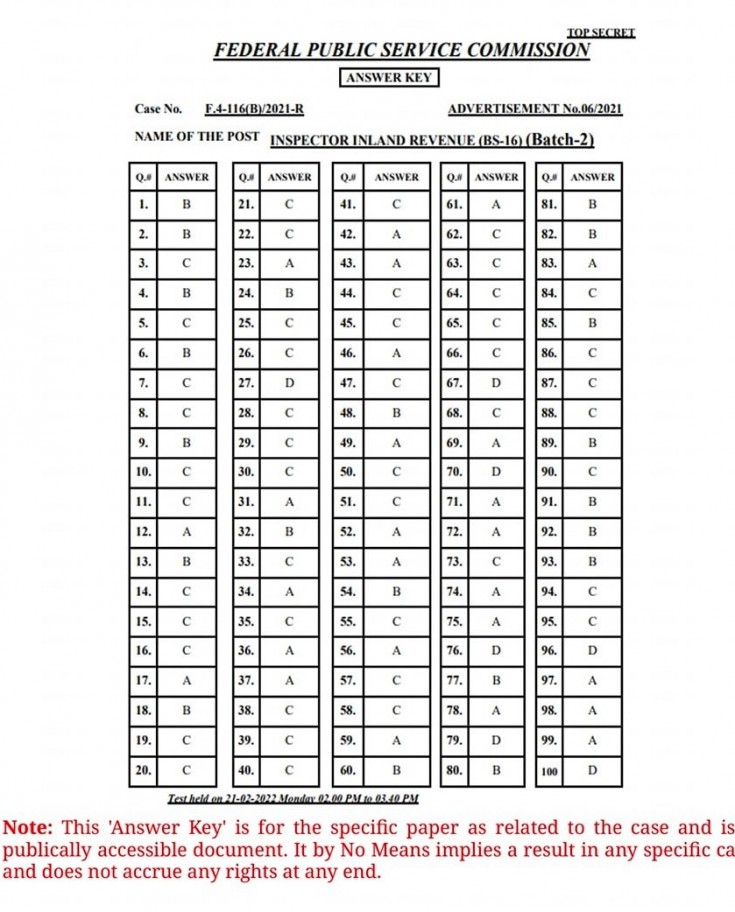

Inspector Inland Revenue Test today solved paper Batch 2 02: 00 Pm held on 21st February 2022. Download today IIR Inspector Inland Revenue FPSC past paper of 2022 along with answer key.

Inspector Inland Revenue Fully solved paper Batch 2

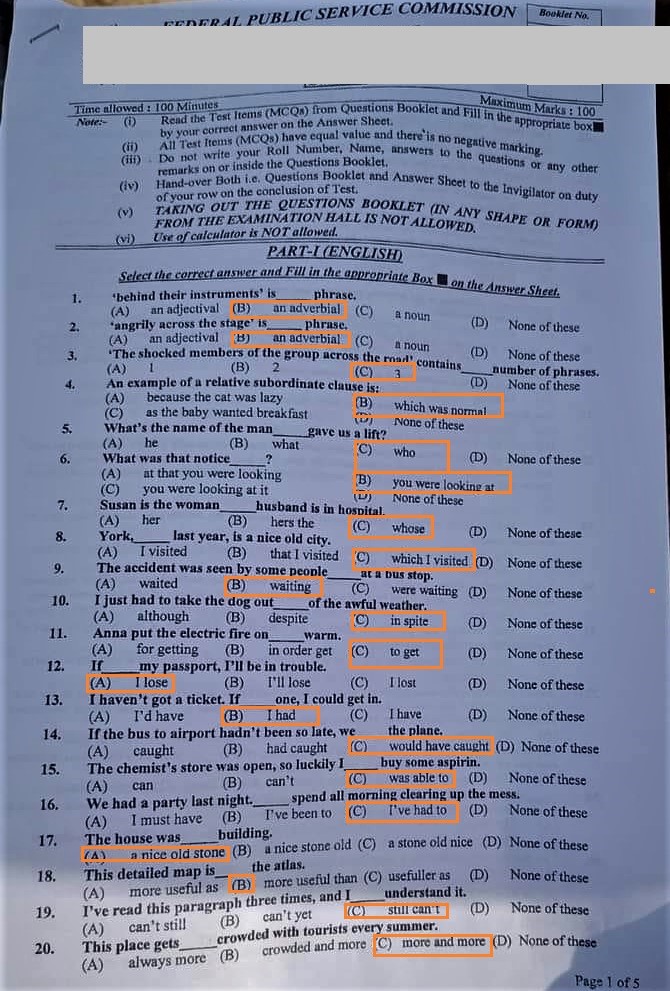

Part 1 English Section

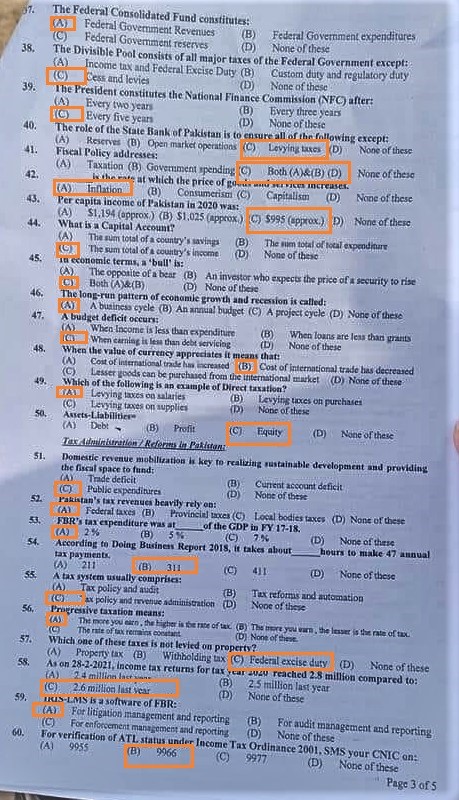

Tax Administration Reforms in Pakistan Inspector Inland Revenue MCQs

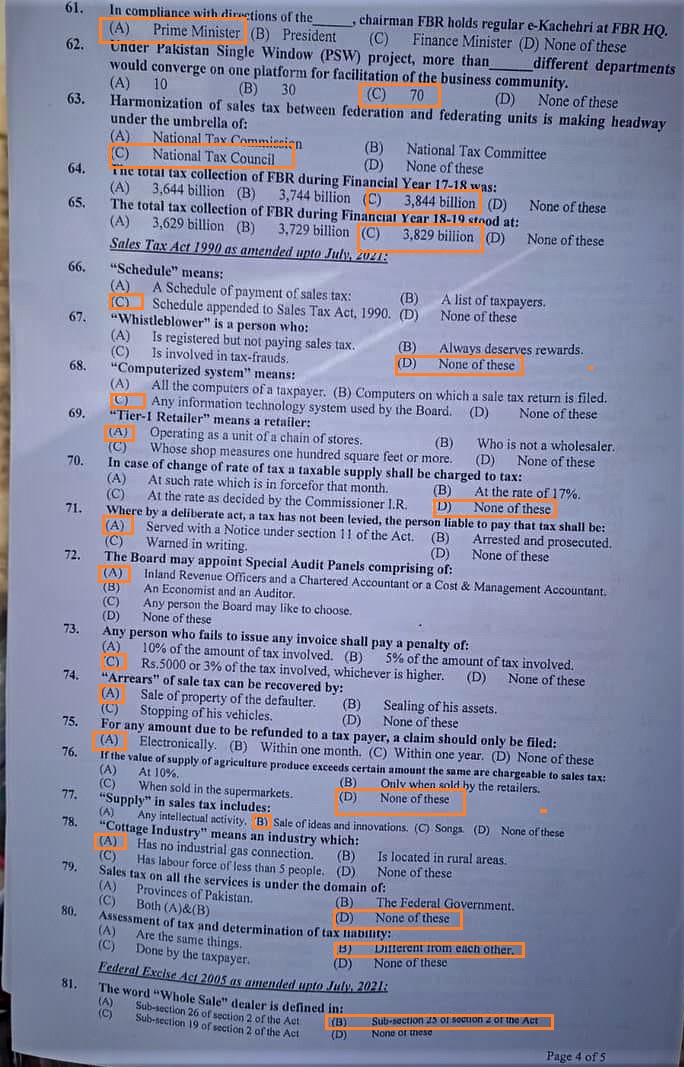

1. In compliance with directions of the ____, chairman FBR holds regular e-Kacheri at FBR HQ ?

(A) Prime Minister

(B) President

(C) Finance Minister

(D) None of the above.

2. Under Pakistan Single Window (PSW) Project; more than _____different departments would converge on one platform for facilitation of the business community ?

(A) 10

(B) 30

(C) 70

(D) None of the above.

3. Harmonization of sales tax between federation and federating units is making headway under the umbrella of ?

(A) National Tax Commission

(B) National Tax Committee

(C) National Tax Council

(D) None of the Above..

4. Tax Collection of the FBR during Financial Year 2017-18 was ?

(A) 3644 Billion

(B) 3744 Billion

(C) 3844 Billion

(D) None of the above.

5. Tax Collection of the FBR during Financial Year 2018-19?

(A) 3629 Billion

(B) 3729 Billion

(C) 3829 Billion

(D) None of the Above.

6. Schedule Means ?

(A) A schedule of Payment of sales tax

(B) A list of tax payers

(C) Schedule appended to Sales Tax 1990

(D) None of the Above..

7. Whistle Blower is a person who is ?

(A) registered but not paying sales tax

(B) Always deserves reward

(C) is involved in tax frauds

(D) None of the Above.

8. Computer System means ?

(A) All the computers of a tax payer

(B) Computer on which sales tax return is filed

(C) any information technology system used by the board

(D) None of the Above.

9. Tier 1 Retailer means a retailer ?

(A) Operating as a unit of chain of stores

(B) Who is not a wholesaler

(C) Whose shop measures one hundred square feet or more

(D) None of the Above.

10. In case of change of rate of tax a taxable supply shall be charged to tax ?

(A) At such rate which is in force for that month

(B) At the rate of 17%

(C) At the rates decided by Commission I.R

(D) None of the Above

11. Where by a deliberate act a tax has not been levied , the person liable to pay that tax shall be ?

(A) Served with a notice under Section 11 of the act

(B) 5% of the amount tax involved

(C) Rs. 5000 or 3% of the tax involved or whichever is higher

(D) None of the Above

- Assets =? Liabilities + Equity

- When capital is introduced by partner , then we should be debited to ? Capital Account

- In economic term in bull is? An investor who expects prices to rise

- Fiscal policy address? Government spending and taxation to influence the economy

- Progressive taxation means? Taxpayer ability to pay

- Schedule means Alternative corporation Tax

- What is meant by Non tariff barrier? A way to restrict trade using trade barriers in a form of other than tariff

- Supply in sale tax includes

- Computerized system mean

- Whistleblower is a person ? Who voluntarily provides information to the public

- Cottage industry mean ?

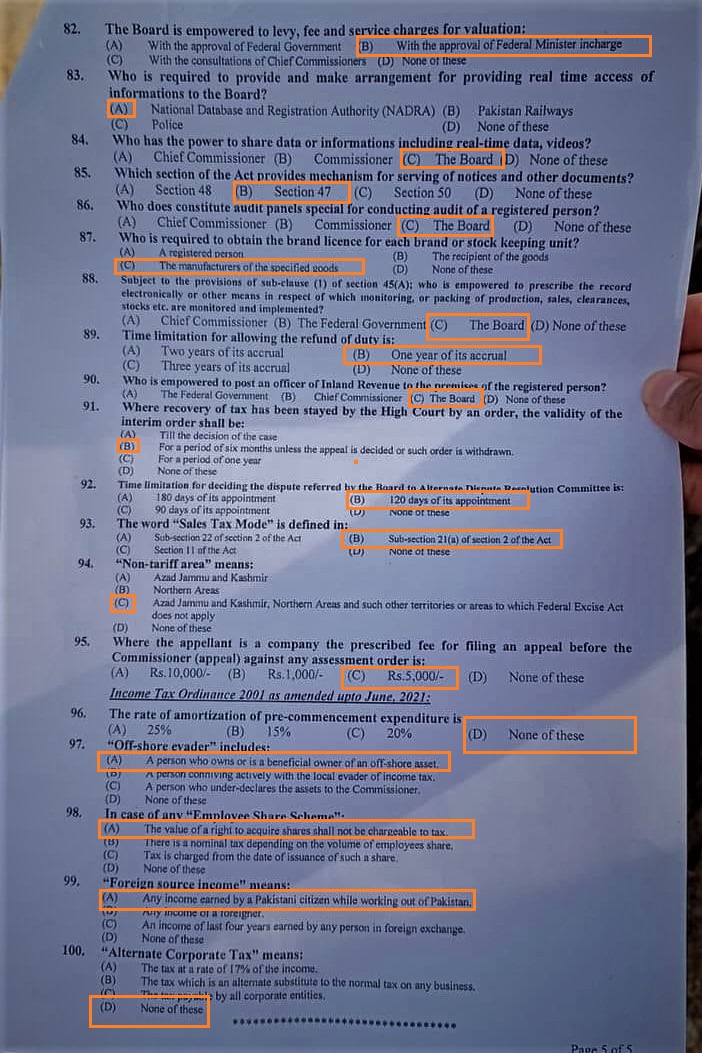

Income Tax Ordinance 2001 MCAs as amended upto June 2021

If you remember MCQs or Questions of today Inspector Inland Revenue Batch 2 Paper please share below in comments.